Table of Contents

ToggleEver been on a long road trip? For me, the best part of the journey is taking pit stops in tiny villages, at the small ‘chai ki dukaan’ and digging into locally packed namkeen to munch with our hot chai. Imagine my surprise then, when during our trip last month, we found namkeens from India’s largest namkeens & snacks company at a roadside chai-wala in a village called Jhunjhunu, 5 hours away from Delhi! I was pleasantly surprised to find other big brands too- biscuits, chips and even fruit juices at his shop.

Rural penetration of large brands has been on a steady rise for the last decade and has picked up pace especially in the last few years. The internet gave rural consumers tremendous exposure to products and categories they didn’t even know existed. They aspired to consume the same products as people did in bigger cities. Since then, CPG brands have been making a beeline for smaller cities and villages, because the sheer potential of that market is mind-boggling.

FMCG trends and the latest IBEF Industry report reflect much the same. In the September quarter of 2021, rural consumption of FMCG goods grew 58% year on year, twice that of urban consumption. Just in the last 2 years, rural markets grew faster than before, underpinned by higher farm income and migrant workers returning home. Rural growth was also driven by a rise in Kirana outlets that more than doubled compared to a year ago.

According to Statista, the market Size of FMCG across Rural India was $100 billion in 2020 and is estimated to be almost $220 billion in 2025. You can very well understand why CPG players are falling over themselves to maximise their rural penetration. But it is not as easy as it seems. Selling to a rural customer is a whole different ball game.

Let’s have a look at the things that are distinct in rural CPG sales in India:

Price Conscious Customers

The buyer persona and consumer demand patterns change as we go deeper into the rural areas. Rural Consumers are very Price-Point sensitive and therefore, not brand loyal. A young farmer with 3 children would rather buy a 100 gms – Rs 5/- pack of namkeen of a local brand than a 50 gms- Rs 5/- branded namkeen because he gets to distribute more amongst his kids. For rural customers, quantity trumps quality.

Ad Hoc Sales

Most people assume that Tier 1 cities contribute the most revenue. That may be true in terms of value, but for most brands, a major volume of sales comes from Tier 2 and Tier 3 cities. Unlike urban areas, where retail outlets are spread more or less evenly across the city, rural areas have shops spread far and between. Typically they will have clusters of 15-20 shops within a kilometre, and then nothing for the next 22-25 kilometres. This also means that for many salesmen in rural areas, the transit time is very high. A salesman may need to spend 2-3 hours just to travel to different villages to cover all outlets in his assigned areas.

In such a case CPG brands find it difficult to service these outlets because they do not have proper beats, or route plans, no store categorization. Compared with their urban salesperson who visits an outlet every 6-7 days, the rural counterpart may visit once in 10-14 days.

Drop size is small, and the frequency with which outlets open and shut shop is much higher than in urban areas. E.g. in the first wave of the pandemic migrant labour went back to their villages and some of them opened ‘hole in the wall’ shops to sustain themselves.

Read: How to Efficiently Manage Sales Territories in Retail Business?

Unorganized Distribution

Unlike rural areas where CPG brands have visibility on their on-ground effectiveness, rural areas do not afford them this capability. Therefore, they have a high dependency on their local stockists/distributors to manage rural sales. These local distributors or sub-stockists have smaller godowns, fewer vans to fulfil retail orders, and service retailers across a much larger area (as retailers are widely dispersed).

Another challenge is that their stocking capacity is not high. Therefore stockouts are quite common. By the time super-stockists fulfil their order, the company has notched up a high volume of ‘lost sales’. To top it all, if brands do not have good distribution partners, they will lose their market share very quickly.

As brands cannot bifurcate regions according to tech usage, geography, outlet penetration, they define things like population density required, the number of consumers served in that area, the per capita income etc to figure out their distribution strategy.

Lack of Infrastructure & Technology

In rural areas, distributors are small and not so evolved. They still use pen and paper to record transactions, which may not always give completely accurate data. So FMCG companies try to encourage them to use technology because they still need this data. Unfortunately, internet availability or mobile networks are so sporadic that urban solutions do not work well in rural markets. So how can brands access that data?

Bringing Rural Tech to the Hinterland

Tech solutions for rural sales need to be agile and simple so that despite the restrictions in the rural market, the distributor is still able to capture all the data points. An automation solution that is specifically created keeping the rural sales challenges in mind can bring in much-needed impetus to building rural penetration.

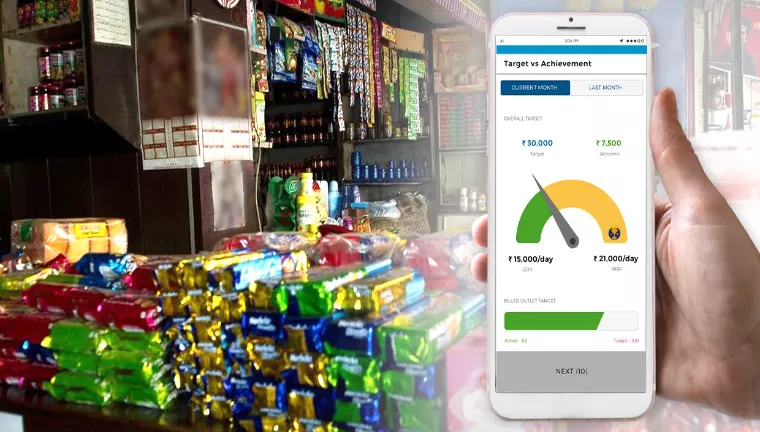

For years now, CPG players have been desperately looking for rural solutions that can work in remote areas. What they need is solutions, like FieldAssist’s Rural SFA app that lets them establish an automated, transparent, rural sales & distribution system, and offers capabilities like types of beat plans, secondary order validation features etc. Anything that helps them identify how many authenticated outlets they have, how many beats they must define, and how many people they must deploy.

And most importantly, the Rural Sales app also lets salesmen punch in orders without the internet! They can visit retailers, record their orders in the app, and at the end of the day find an internet point and sync their app to update all orders in one go. Similarly, a mobile-friendly, easy to use DMS or Distributor Management System helps the distributor or sub-stockists to do basic tasks efficiently, like goods receipt, inventory management, van booking, billing & purchase order request etc.

When one of India’s biggest biscuits and cookies manufacturers adopted the rural SFA app, not only did they get visibility on their 2,45,000 outlets, but they also realized that they had the potential to cover almost 5,00,000 outlets! Now they had a clear view of where they were present; they could define the First Call time and they were able to cover more outlets in a day because they had proper beats to maximize outlet coverage. They could also see which outlets were buying from them and which weren’t.

Can you imagine what that kind of visibility can do to your rural penetration? Get on a call with us, and let us show you how our ‘rural tech’ is impacting the growth of some of the biggest FMCG companies.

About Post Author

Nikhil Patwari

Nikhil always works towards making the app user’s experience more rewarding and empowering. Also a self-described wanderlust, his secret talent is being able to travel to exotic places on a shoe-string budget.