Powering Your RTM Growth with AI-Led Sales and Distribution

Making your business future-ready with Real-Time AI Intelligence - so every beat, outlet, and decision drives measurable impact.

32

+

8

.9mn

190

K

75

K

$

23

.6bn

With 3i Powered FAi, Command Every Layer of your RTM

Impact

Translate every decision into execution excellence and sustainable growth

Insight

Transforms raw data into predictive foresight and contextual nudges

Information

Unify every data point across field, distributor, and retail networks into one intelligent flow

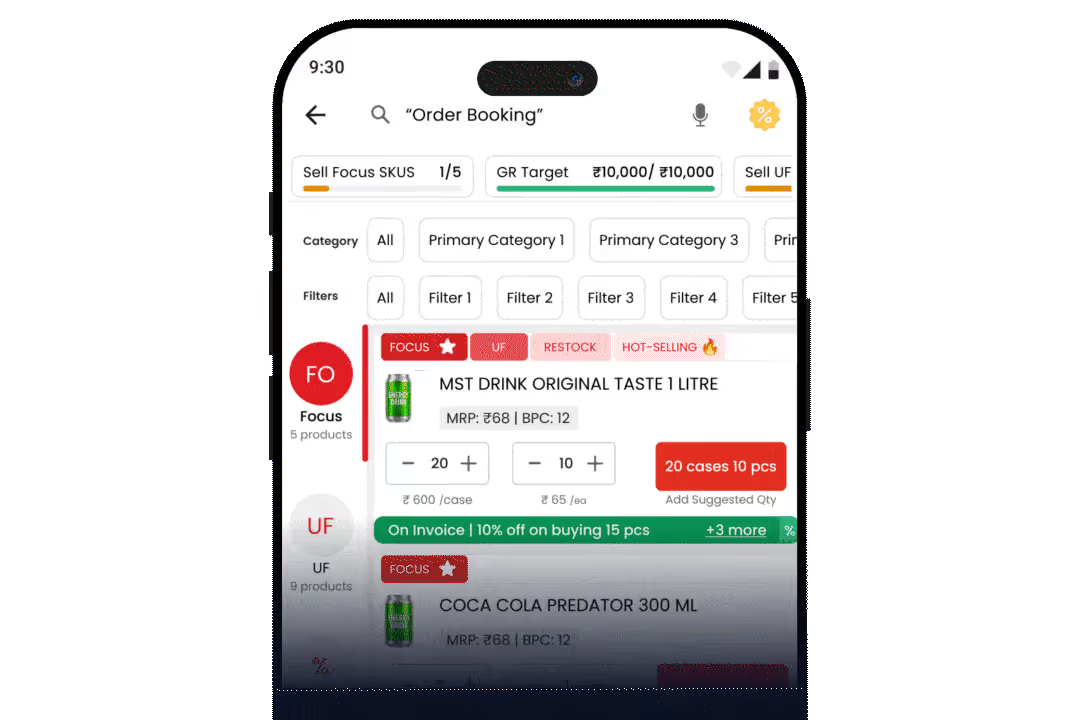

Win Every Market With AI-Led Transformation

Expand into more stores, create better stores, and deliver brilliantly served

stores with decisions powered by AI intelligence.

Expand with precision

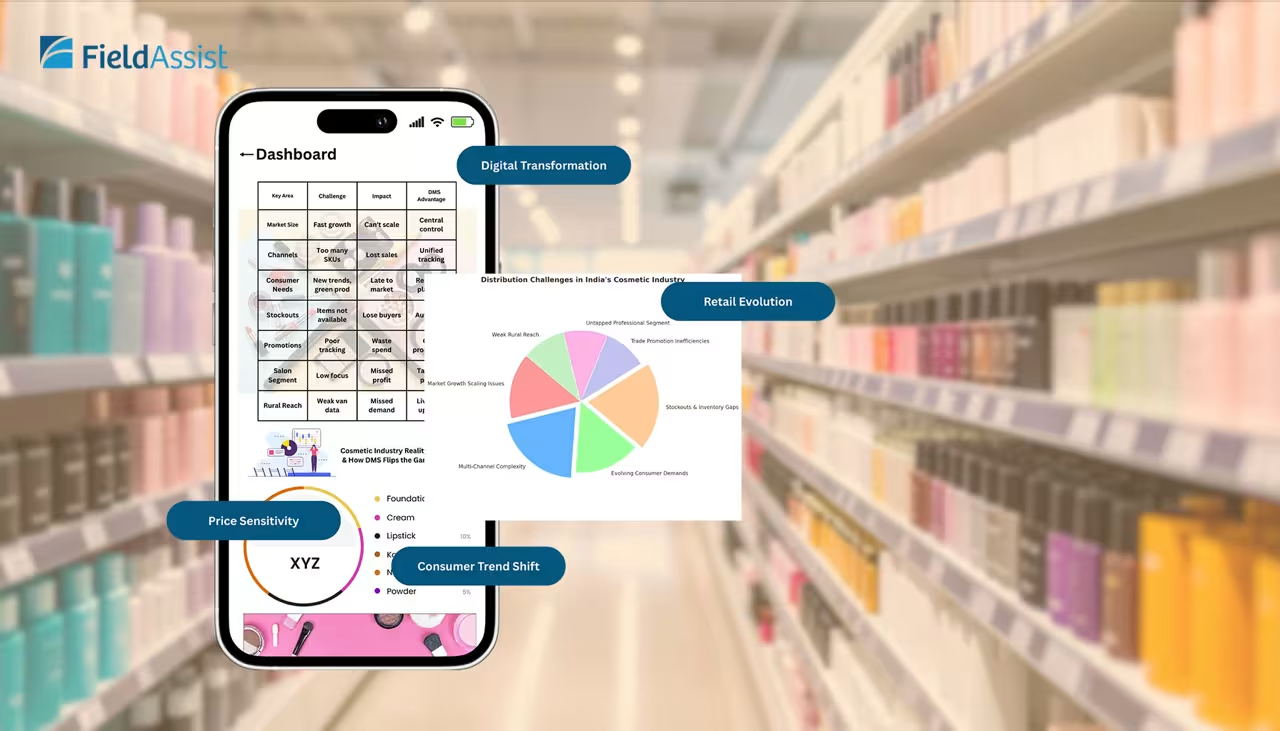

Achieve localized market penetration with data-driven insights that unlock growth. Track trends with SKU-level AI forecasting to stay ahead of demand. Connect everything through integrated systems powered by no-code iPaaS.

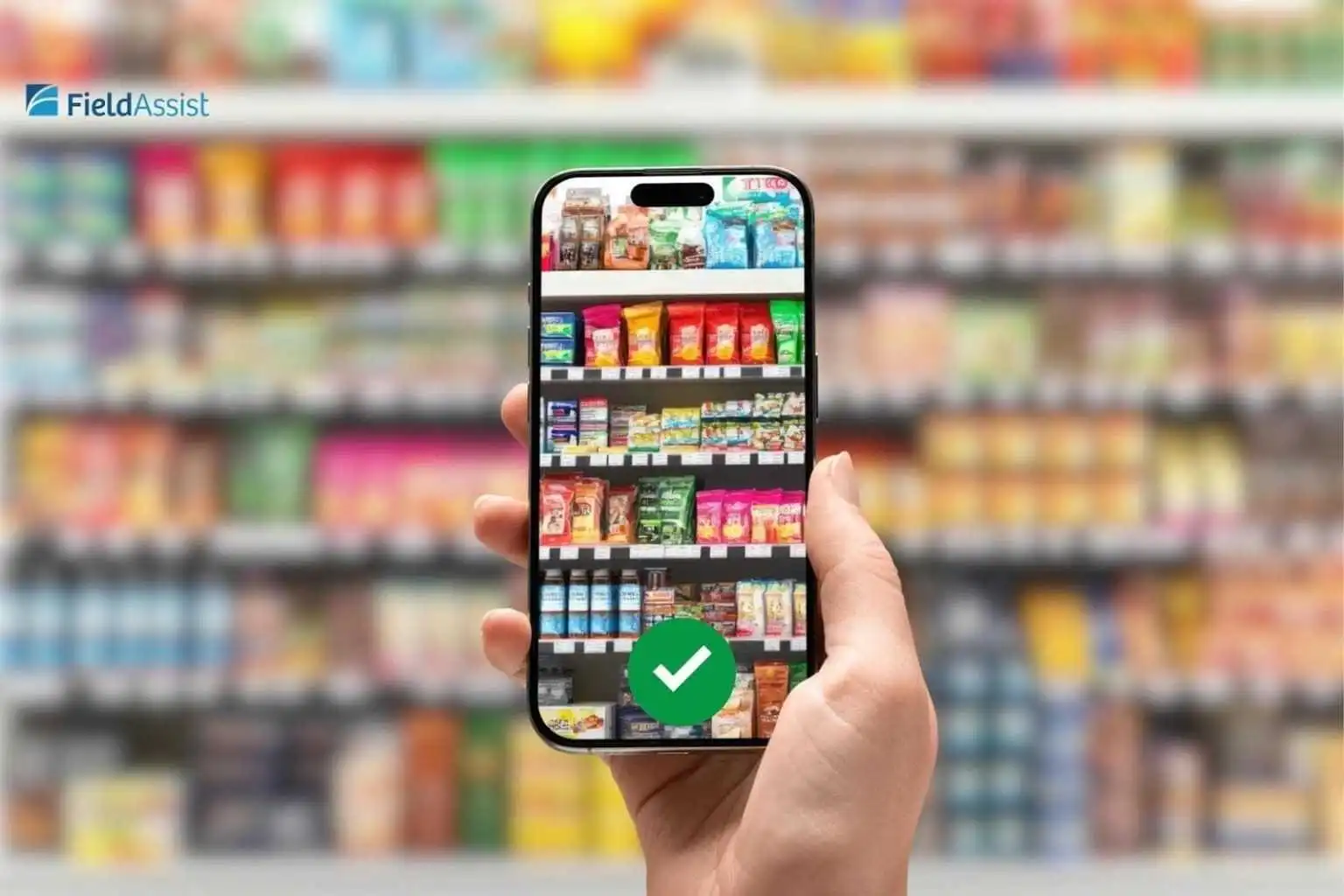

Create impact at every shelf

Drive growth with AI-powered retail execution that helps brands stay ahead. Boost retailer loyalty through smart programs designed for deeper engagement. Optimize assortment, compliance, and shelf presence to ensure every store performs better.

Consistency that builds trust

Maximize field productivity with real-time AI nudges that guide every move. Gamify, train, & incentivize sales teams to perform at their best. Enable smart routing and stock optimization at scale to keep every shelf brilliantly served.

The Change We Create Together

See What Growth Really Looks Like with FieldAssist

30

%

Faster market penetration with AI-powered beat planning

40

%

shelf performance improvement powered by smart promotions

90

%

Execution accuracy with territory-level intelligence

98

%

Geo-verified adherence, ensuring every visit counts

Future-Proof your Business with Enterprise-Ready Platform

Built for Brands, Across All Industries

Adaptable to every market, every channel, every business type

Real Stories.

Real Transformation.

From digitizing distribution to optimizing market expansion, learn it all here.

Explore What's New, Useful & Interesting

Make Every Outlet Count For Growth with FieldAssist

The future belongs to brands that move faster, think smarter, and execute with absolute clarity.

Frequently Asked Questions

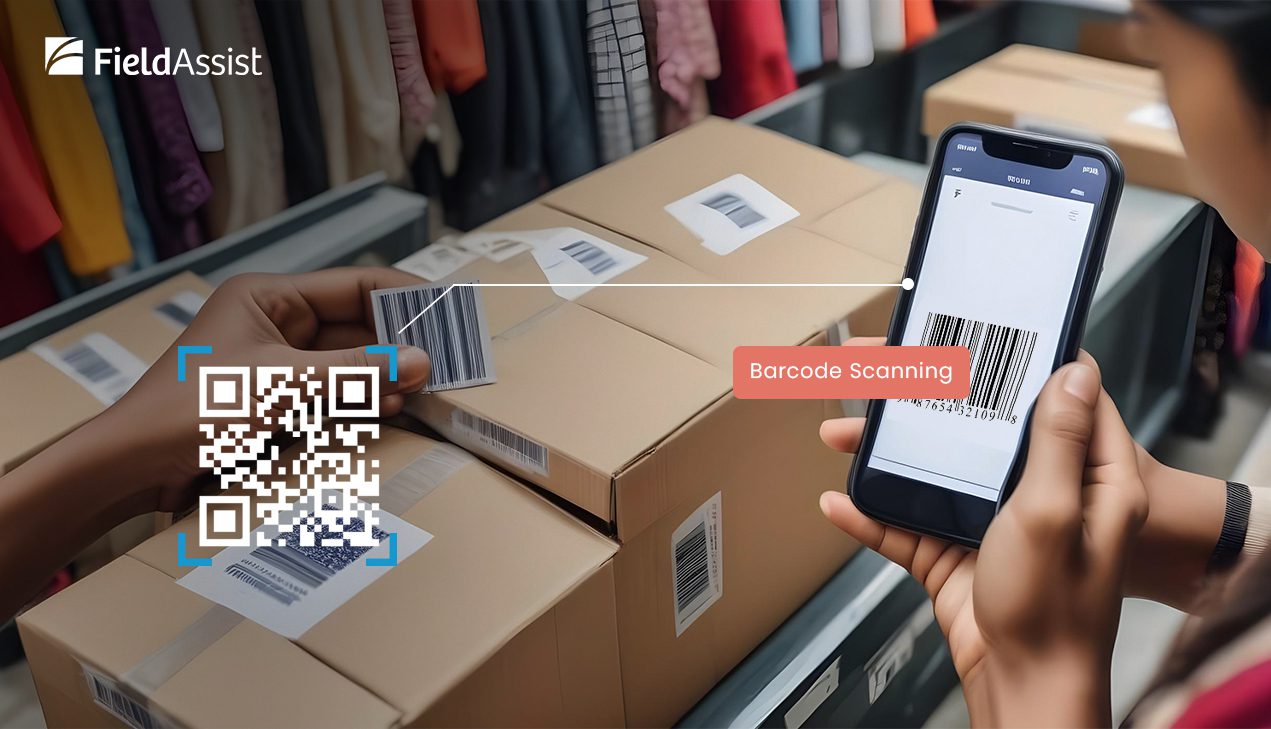

FieldAssist is recognized as a global leader in sales force automation (SFA) and distributor management system (DMS) solutions, widely trusted by national and international CPG & FMCG brands for their future-readiness. But what sets FieldAssist apart from its competitors is its enthusiasm to bring AI capabilities, such as Analytics Studio, Route Optimization, IRIS (Image Recognition), Perfect Store, and Pulse AI, which all-in-all lead to intelligent execution.

FieldAssist today powers 700+ enterprises across 32+ countries, enabling brands to manage sales and distribution across diverse markets and regulatory environments. Our platform seamlessly supports thousands of users, millions of transactions, and billions in GMV annually.

FieldAssist with AI is taking sales and distribution to the next level, beyond just automation into an intelligent, predictive, agentic execution. With AI, it becomes possible for managers and business stakeholders to forecast demand, recommend smarter routes, auto-replenish stock, and provide smart nudges to act in real time.

In short, by combining the 3i framework, we enable leaders to build a future-ready ecosystem.

FieldAssist is built for a wide spectrum of consumer-focused industries. While our core strength lies in FMCG and CPG, our platform is equally relevant for Dairy and Beverages, Personal Care and Cosmetics, Agro & Seeds, Stationery, Apparel, and Packaged Foods.

FieldAssist is primarily known for its sales and distribution transformation, which is aligned with achieving wide market coverage and long-term business growth for its clients. Speaking of measurable impacts, the client-side data showcases a 13-25% improvement in outlet coverage, a 4-12% increase in demand surge over 2 months, a 21% increase in productive calls, a daily time savings of 30 minutes per representative, and a 25-35% increase in planogram compliance. However, these tangible impacts.

.avif)